- The GBP/USD softened as the dollar strengthened later this week, driven by major US and UK data releases.

- Traders price in a 25 basis point cut by the Bank of England by year-end.

- Traders await the FOMC rate decision and Powell’s commentary next week.

The GBP/USD weekly forecast remains subdued as the pair consolidates near the 1.3325 level, followed by key releases from the UK and the US. The UK economic indicators slightly boosted the pound sterling. However, the dollar’s safe-haven demand restricted further upside, keeping the pair steady.

-Are you interested in learning about the Bitcoin price prediction? Click here for details-

In the UK, the economic data reflected a resilient economy. The retail sales figures for September stood at 0.5% MoM, exceeding expectations of a 0.2% decline. Meanwhile, the August figures were 0.6% higher, driven by high jewelry demand.

The S&P Global flash PMI data revealed improved results. The Composite Index results rose to 51.1, and the Manufacturing PMI climbed to 49.6, the best figures of the year.

Consequently, these results suggest that the Q3 GDP growth could exceed the expected 0.3% estimate of the BoE. While markets are cautious, investors’ hopes of a 50 basis point cut over the next year persist. A 25 basis point rate cut by the BoE is highly expected in November.

On the US side, the US CPI revealed a softer-than-expected inflation at 0.3% MoM and 3.0% YoY, supporting rising Fed rate cut bets, one in the coming week and another in December. However, the strong US S&P Global PMI above 50 shows growth momentum and boosts demand for the greenback.

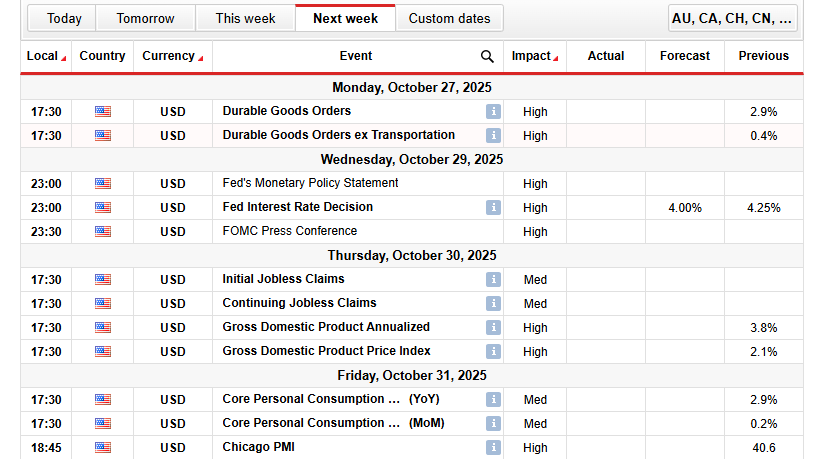

GBP/USD Key Events Next Week

The major events next week include:

- Fed’s Monetary Policy Statement

- Fed Interest Rate Decision

- FOMC Press Conference

- Initial Jobless Claims

- Chicago PMI

- US GDP

- US Core PCE

Next week, traders anticipate the Fed’s interest rate decision, the FOMC press conference, initial jobless claims, and the Chicago PMI for insights into labor conditions and expectations of Fed easing and policy direction.

GBP/USD Weekly Technical Forecast: Deeper Correction Below 200-DMA

The GBP/USD weekly outlook reflects the pair’s cautious approach, holding steady around 1.3320. The price stays below the 50- and 100-day key moving averages, while the 200-day MA around 1.3230 is a rising support zone.

-Are you interested in learning about the forex signals telegram group? Click here for details-

The RSI is at 43.68, signaling bearish momentum and indicating a further downside potential unless a sustained breach above the resistance zone occurs. The price action holds between the 1.3300 and 1.3400 levels, where sellers regain control amid limited upside. A drop below the 1.3300 level could extend the ongoing downside. Conversely, a decisive break above the 1.3350 level could trigger a short-term rebound.

GBP/USD Support Levels Forecast

GBP/USD Resistance Levels Forecast

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.